The math of a home sale is relatively straightforward. Sellers list their home at a certain price, a buyer makes an offer, and eventually the two parties reach a final, agreed-upon price. However, between these two points in the selling process, there are several other figures that go into to setting a home’s value that you should be aware of. Your real estate agent will be your best resource in interpreting the different values associated with your home and what they mean as you prepare to sell.

Understanding the Value of Your Home

Listed Price (Asking Price)

Also known as an asking price, the listing price of a home is the price at which a seller lists their property when it goes on the market. The listing price is a gross price, meaning the costs associated with selling the home are not included. A real estate agent’s Comparative Market Analysis (CMA) will accurately set your home’s listing price, accounting for the various factors that influence home prices including location, condition, seasonality, local market conditions, and more.

The listing price is a starting point for negotiations with buyers. You may receive an offer that matches your asking price, but it’s common for buyers to make offers at other price points. You can either accept, reject, or make a counteroffer in response until you and the buyer reach an agreement.

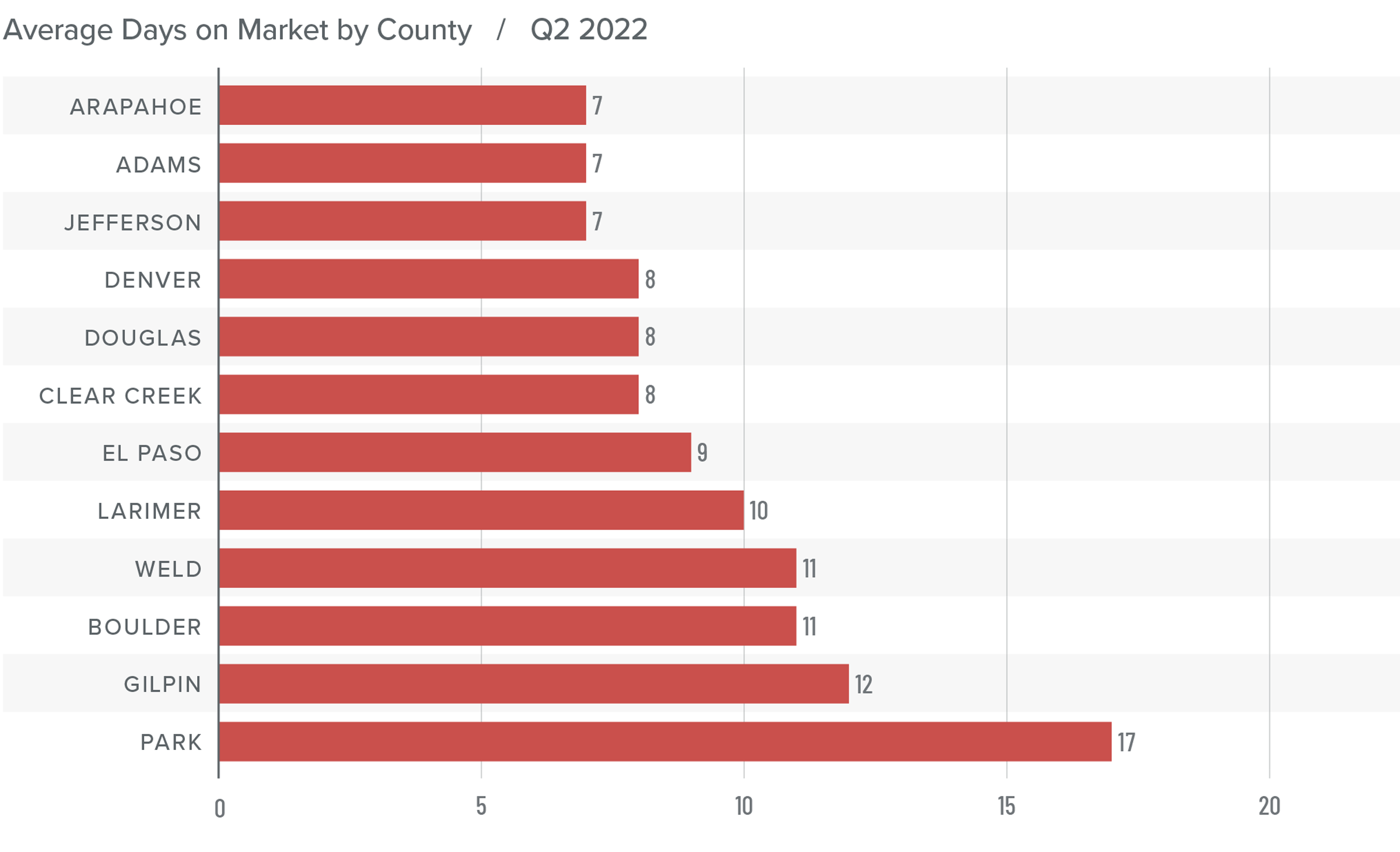

Whether you’re selling in a buyer’s market or a seller’s market may determine you and your agent’s approach to the listing price of your home. There may be certain pricing tactics you can employ to either drive buyer attention or increase competition, but if your home’s listing price strays too far from its market value (see below), it could stay on the market for longer than you expected.

Market Value

As a seller, you’re interested in what buyers are willing to pay for your home. By taking into account a home’s condition, size, curb appeal, and features, as well as local market conditions and what comparable homes are selling for, a home’s market value reflects the price buyers will pay for a property.

Image Source: Getty Images – Image Credit: damircudic

Appraised Value

A home’s appraised value is determined by a professional appraiser to ensure that the lender is loaning the correct amount of money for the home. Appraisers assess the home’s layout and features, square footage, gross living area (GLA), overall condition inside and out, home updates and remodels, and more. If the appraised value comes in too low or too high, the buyer and seller must renegotiate for the deal to go through. In competitive markets, buyers may include an appraisal gap guarantee in their offer, which states that the buyer will cover the difference between the price of the home and the appraised value.

Sale Price (Purchase Price)

Also known as the purchase price, your home’s sale price is what it ultimately ends up selling for. Once you and the buyer have reached an agreement on the terms of the transaction, the buyer will have the home inspected and final negotiations may occur based on the findings of the inspection. Familiarize yourself with the Common Real Estate Contingencies buyers may include in their offer and what they mean when selling your home.

Net Proceeds

So, how much do you actually make on the sale of your home? After subtracting the total costs of selling from your home’s sale price, you’ll arrive at your net proceeds. This is the amount you walk away with from the transaction.

Assessed Value

Your agent’s CMA is a reliable method of determining your home’s value for its eventual sale, but its assessed value is used for taxation purposes. Employed by local municipal or county entities, an assessor will conduct a review of your property to determine its assessed value. The assessor’s findings are passed to local tax officials, who use that number to calculate the home’s property taxes.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link